Market Opportunities

Global legal cannabis spending is projected to reach nearly $50 billion by 2026 (CAGR of 16% from 2020) and $57 billion by 2030. Recreational use will account for 67% of spending, with medical cannabis covering the remaining 33%.

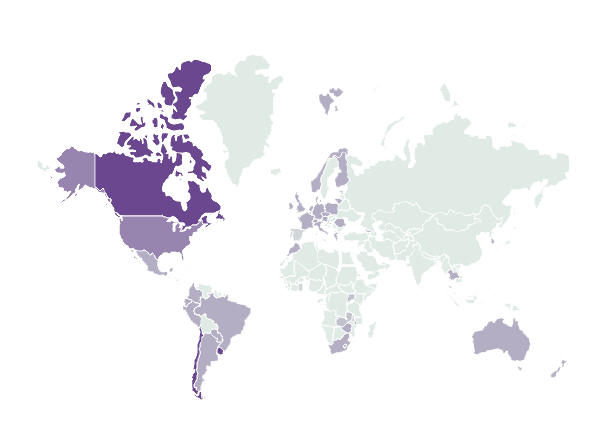

North America’s legal cannabis market reached $33.6 billion in 2023, growing 10% year-over-year, and is expected to hit $46.5 billion by 2027.

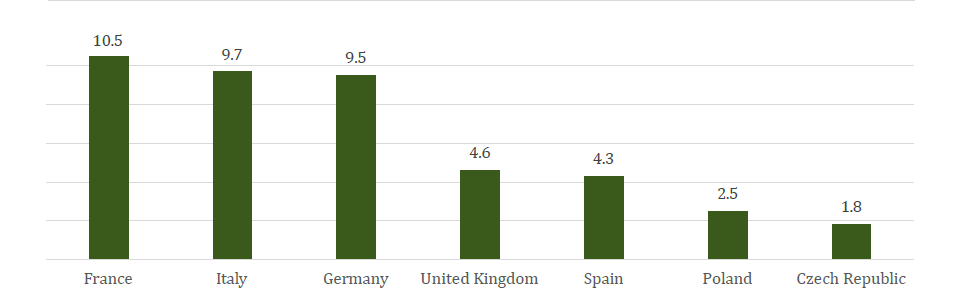

The EU, with a population of nearly 450 million, offers strong market potential. Germany (83M), France (68M), Italy (59M), Spain (47M), and Poland (38M) are the largest member states. The UK, Switzerland, and Norway add another 82 million people combined.

A 2015 ECHR report stated drug use should not be illegal if it doesn’t harm others. In 2020, the UN recognized cannabis’s medical potential, and the EU ruled that CBD is not a narcotic, opening doors for product approvals.

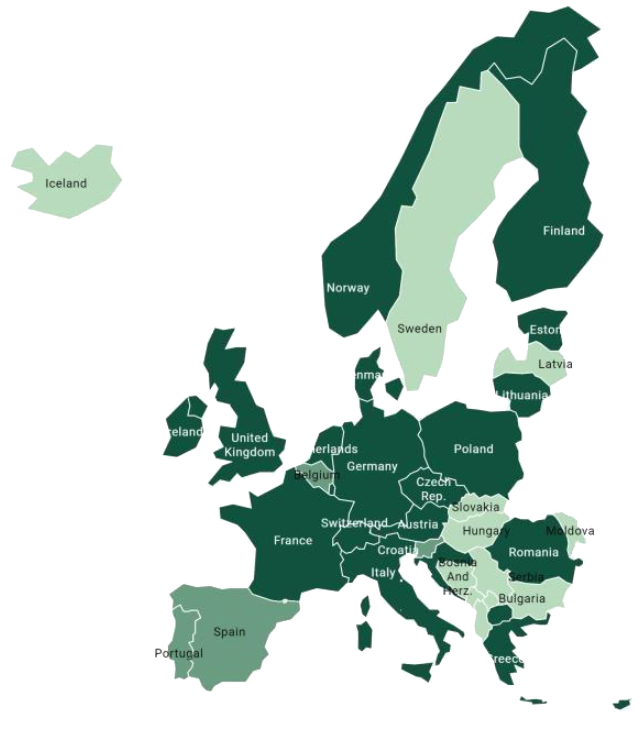

Medical cannabis is now legal in 22 European countries. Eleven countries have decriminalized personal recreational use, while Malta, Luxembourg, and Germany have fully legalized it—Germany joined in February 2024.

Prohibition Partners valued Europe’s legal cannabis market at €354 million in 2022 and €516 million in 2023, with projected growth to €2.1 billion by 2027 at a CAGR of 45%.

Global Cannabis Market

In 2020, global cannabis sales hit $20.2 billion (up 40% from 2019), rising to $28.8 billion in 2021 (+43%) and $31.3 billion in 2022 (+9%). In 2023, global sales exceeded $35 billion (+12%).

Global spending is projected to reach $50 billion by 2026 (CAGR 16%) and $57 billion by 2030. Of this, $46.5 billion will come from the U.S. and Canada, with $10.5 billion from other markets. Rest-of-world markets are expected to grow the fastest, reaching $2 billion by 2030. Recreational use will account for 67% of spending; medical cannabis will make up 33%.

Legal medical cannabis spending outside North America rose 60% in 2023, from $0.9B to $1.4B, driven by Europe and Australia. International sales are expected to reach $3.5 billion by 2026 (CAGR 37%).

Key Trends

- Early U.S. and Canadian regulations inspired global adoption. Legal recreational use in Canada and many U.S. states triggered wider legalization trends.

- Europe’s legal cannabis market was valued at €354M in 2022 and €516M in 2023, projected to hit €2.1B by 2027 (CAGR 45%).

- Oceania is expected to grow from $100M (2021) to $1.2B (2027); Australians spent $234M in 2022, nearly doubling in 2023.

- Latin America’s $140M market (2023) is led by Brazil, Mexico, and Colombia, with a CAGR of 104% and 32% of non-North American spending.

- Africa, with over 10% of global demand, is expected to rank fourth globally.

European Cannabis Market

Europe, home to 450M people and a €16.6T GDP, has 25M estimated cannabis users. Medical cannabis is legal in 22 countries; 11 have decriminalized recreational use, and 3 (Malta, Luxembourg, Germany) have legalized it.

In 2015, the ECHR declared that drug use should not be illegal if it doesn’t harm others. The EU saw major growth between 2018–2019, with new medical programs and over €500M in investment.

Germany leads Europe, liberalizing medical cannabis in 2017. Italy legalized medical use in 2013. Other active countries include Belgium, Croatia, Czech Republic, Denmark, Greece, Finland, Poland, Switzerland, and the Catalonia region in Spain. Malta legalized medical cannabis in 2018 and recreational use in 2021. Luxembourg passed its recreational law in 2023. Cyprus, Ireland, and France have launched pilot medical programs. The UK introduced Europe’s first private patient registry.

In 2020, the UN recognized the medical potential of cannabis, and the EU Court of Justice ruled that CBD is not a narcotic. That year, 17 clinical trials were active across 10+ countries. Switzerland launched adult-use cannabis in 2022 after a pandemic delay.

Cannabis social clubs exist in Spain, Belgium, UK, Austria, Germany, Czech Republic, and more, but broad legalization of recreational use remains limited. However, this is expected to shift by 2025.

Germany became the third European country to legalize recreational cannabis in February 2024.

Market Forecast

Prohibition Partners values Europe’s legal market at €354M (2022) and €516M (2023), with sales expected to reach €2.1B by 2027. Brightfield Group projects over $3.1B globally by 2025 (CAGR 52%). BDSA forecasts $4B globally by 2025. New Frontier Data estimates total cannabis demand in Europe at $42.9B.